Spring is traditionally a time to dust off the cobwebs, take stock and put plans in place for the year ahead. It also presents the perfect opportunity to review fleet policies.

A whole host of legislative and tax changes have just arrived with the start of the new tax year that are threatening to blow you off course. From the introduction of the WLTP and RDE2 testing standards, further tax increases for diesel and plans for multiple Clean Air Zones. Managing this on top of the daily demands of running an efficient vehicle operation can be a struggle.

To help you get your house in order and set yourself up for a highly productive 2018, we've covered off some of the main headlines that you need to be aware of over the coming months.

The only certainty in life is taxes

The new WLTP and RDE2 testing standards are now in full swing. It’s a huge step towards ensuring manufacturers present accurate emissions and consumption figures about their vehicles. It will empower fleets and consumers alike to make better informed decisions in future.

Manufacturers have started to publish emissions figures based on the new standards but, in some cases, the calculations are 20% higher than before. Your company car drivers will be feeling the brunt of these increases through equivalent hikes in the tax they pay on some of the most popular company cars.

Meanwhile, Vehicle Excise Duty (VED) for newly registered diesels is now calculated as if they are in the tax band above, unless they meet the new vehicle emissions testing standards and this is squeezing drivers’ wallets even further.

Add to this the Company Car Tax subsidy for most diesels rising from 3% to 4% in Benefit In Kind (BIK) and it’s easy to understand why you may be inclined to re-evaluate the fuel types you make available in your fleet policy.

Assessing vehicle suitability based on driver profiles and journey types over the coming months will be key. Check out our recent guide to Plug-In Hybrid integration for more information about the benefit of adding these types of electric cars to your vehicle list.

Your drivers can also use our helpful Tax Calculator to see how the tax changes impact them directly.

The true cost of ‘free fuel’

If your drivers benefit from having their fuel paid for by the company, they’ll now pay more tax in order to do so. The Government’s raised the fuel benefit from £22,600 to £23,400. That means, for many drivers, the cost of the tax payable as part of this benefit may be more than the cost of the fuel itself. ‘Free fuel’ then becomes much less attractive.

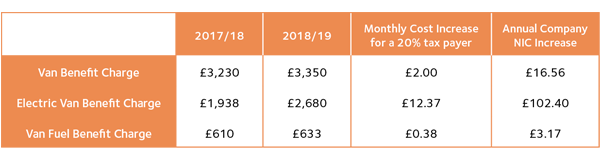

Meanwhile, the BIK charge for drivers who use their company van for private use has increased for both electric and traditional vans.

Drivers who qualify for a Plug-In electric car however, will not incur benefit in kind tax on the electricity used to charge their vehicles at work. This goes for non-company car drivers too.

It’s worth considering how electric vehicles could boost your employee benefits package in 2018. Read our recent white paper on Plug-In Hybrid electric vehicles for more information.

Cleaning up with CAZ

The Autumn Budget signalled a clear message that cleaning up UK air quality is now firmly on the Government’s agenda. We’re already seeing progress in this area with the London Ultra Low Emission Zone (ULEZ) locked down for 2019 in addition to the other five cities under scope (Birmingham, Derby, Leeds, Nottingham and Southampton). Further local authorities are now also consulting on their own solutions.

As more information is made available on how the various Clean Air Zones (CAZ) will operate and what restrictions apply, it will become increasingly important for you to review your fleet and travel policies to ensure they remain cost effective.

If you would like to learn more about CAZ and how it might impact you, your business and your employees, register here for our Nottingham event on the 27th June. Click here to view the highlights of our last successful event.

Businesses looking to shift from diesel into petrol face fresh challenges following the reduction in Lease Rental Restriction (LRR) from 130gms/km2 CO2 to 110gms/km2 CO2. Companies can now only claim Corporation Tax Relief on 85% of the vehicle's rental with CO2 greater than 110gms/km2. Petrol usually has a higher CO2 equivalent when compared with diesel which places further downward pressure on fleet budgets.

The change highlights the value of Total Cost of Ownership (TCO) based policies which factor in extra charges such as LRR. Through TCO you’ll gain a rounded view of how much your fleet is costing your business so don’t have to worry about any hidden or unaccounted charges. Get in touch with us for more information about how we can support you with TCO calculations.

SPEAK TO THE EXPERTS

Our team are on hand to provide advice and guidance on all of these areas, plus specialist support on a whole range of topics from funding methods to alternative fuels.

Contact us on the details below or email: enquiries@lombardvehiclesolutions.co.uk