As you may already know, following the Government’s Budget update last month, there have been some changes relating to the laws surrounding diesel cars which are due to come into effect from April next year. These changes only affect passenger vehicles such as company cars. Commercial vehicles, such as LCVs, are exempt from the new rules.

What is the Real Driving Emissions Test (RDE)?

This test was introduced in September 2017 and is designed to measure the pollutants (such as NOx) that a car emits when driving on the road rather than in a laboratory. In the Budget, the Government announced that RDE Stage 2 (RDE2) will be introduced from April 2018 in which the acceptable level of NOx will fall further. This standard will be mandatory for all diesel cars from 2020. The important thing to note is that, currently, there are no diesel cars that meet the new RDE2 standard.

What impact does RDE2 have on the increase to VED for diesel cars?

The Government announced that from April 2018 the VED for newly registered diesel cars will be calculated as if they are in the tax band above, unless they meet the new RDE2 standard. Because no diesel cars currently meet the new standard, this means that from April 2018 all diesel cars will be placed into a higher VED tax band during their first year of registration.

So, if you currently drive a diesel and you’re thinking of renewing the same model after April next year, you’ll move into the tax band above until April 2019. That means your VED bill will be higher. Take a look at our Tax Calculator to see how much you will pay under the new rules.

How does RDE2 affect the changes to Company Car Tax?

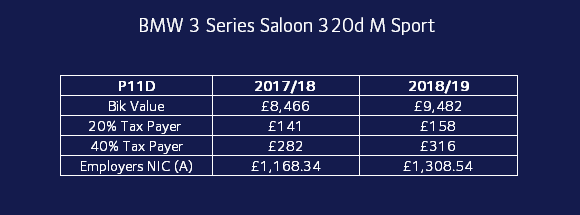

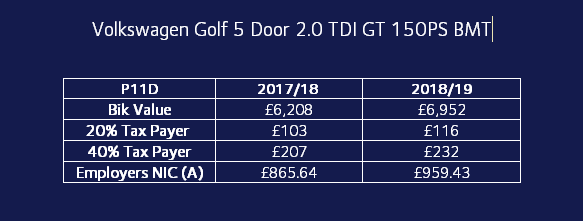

The Government also announced that from April 2018 all diesel cars that don’t meet the criteria set out in RDE2 will see their Company Car Tax rise from 3% to 4%. Again, because no diesel cars currently meet the RDE2 standards, all diesel cars will be affected by this change. Here's the impact of the changes on two popular company cars:

New Allowances for AFV's

The good news for company car drivers is that the Government has again made allowances to support the uptake of Alternatively Fuelled Vehicles (AFV’s).

- The Government announced that company car drivers will not pay BiK on the electricity when charging their electric vehicles at work.

- Plans were announced to prioritise Alternatively Fuelled Vehicles (AFVs) with a pledge to plough £400m of investment into the UK’s electric vehicle charging infrastructure.

This announcement supports businesses that are ready to use AFVs as part of their fleet. What’s more, with growing manufacturers investment, the vehicles in this space are radically advancing making the move easier than ever before. If you'd like to learn more drop us a line or take a look at some of the best AFV’s from 2017.